A Biased View of Financial Education

Wiki Article

Financial Education - Truths

Table of ContentsSome Of Financial EducationFinancial Education Fundamentals ExplainedTop Guidelines Of Financial EducationWhat Does Financial Education Do?The Best Guide To Financial Education

So do not be terrified! As your kids grow older, share your personal experiences as well as the money lessons you discovered, for better or for even worse. If you've had troubles sticking to a spending plan or gotten involved in credit-card financial debt, be truthful with your teenager concerning your errors so they can find out from your experience.While the information provided is thought to be factual as well as existing, its precision is not assured and also it should not be considered as a total evaluation of the subjects talked about. All expressions of viewpoint reflect the judgment of the author(s) as of the date of magazine and also are subject to alter.

Donna Paris I am an author living in Toronto and also really wish Mydoh was around when she was a kid. I might have found out a lot about managing money. My number-one suggestion? Start conserving as early as feasible, compound passion is a magical point. But as I have actually likewise discovered, it's never ever too late to start saving!.

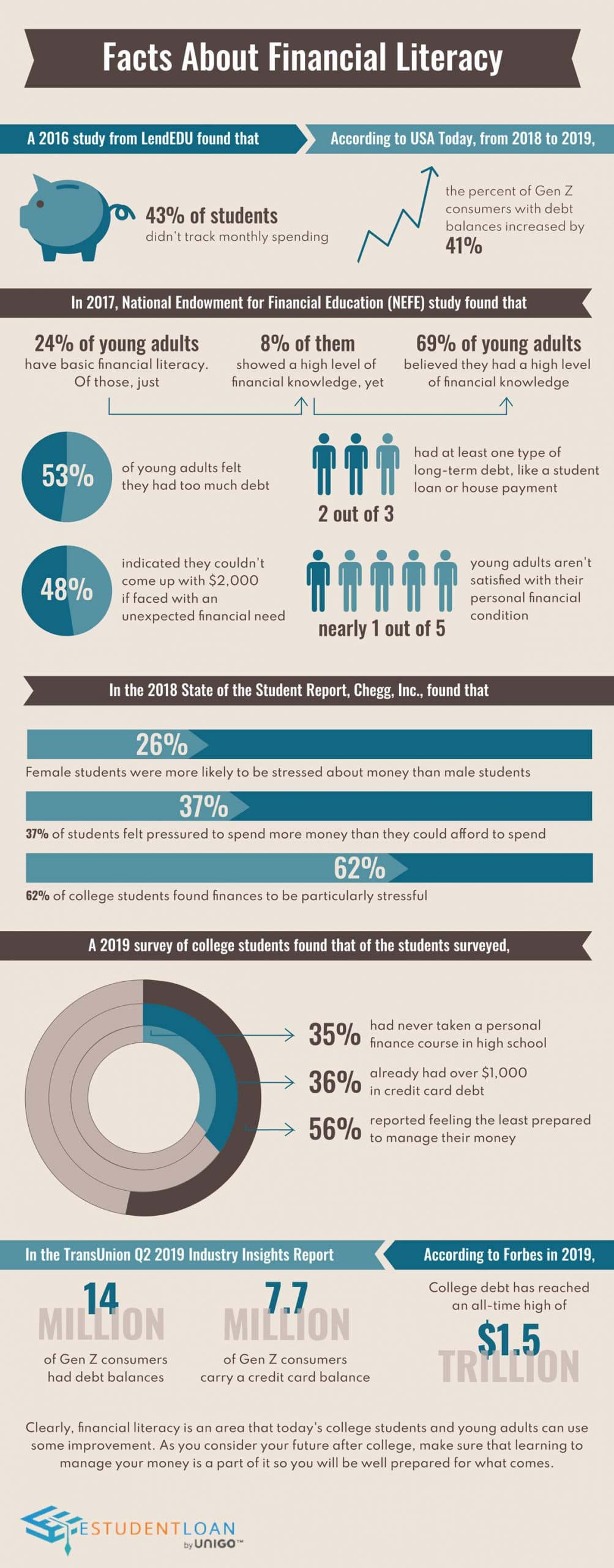

Savings rates are reducing while debt is raising, and earnings are continuing to be stationary (Best Nursing Paper Writing Service). University student who focus on economic proficiency will certainly have the ability to get rid of these obstacles as well as live easily in the future. Congress set up the Financial Literacy and Education Payment under the Fair and also Accurate Credit Report Purchases Act of 2003.

8 Easy Facts About Financial Education Described

The Payment looked for to complete this by producing a national monetary education web site, . Through the Commission's website, they developed 5 key monetary proficiency principles. One crucial component of economic literacy is the capability to make money. But much more than that, it's about the understanding of what takes place to the money you make, consisting of: The amount you take residence on your paycheck The benefits your company provides The quantity you pay in taxes as well as where that cash goes It's especially essential that young people discover this principle of monetary proficiency early before they join the labor force.Saving is one of one of the most crucial means to plan for your economic future. It is just one of the most important concepts for youngsters to discover. This incorporates everything from how to open up an interest-bearing account to exactly how to really save money. An important component of this principle is to create the habit of cost savings.

Lots of young individuals obtain their first part-time task in high school or university yet then have no financial obligations. As a result, they can invest their cash on fun.

It additionally includes the ability to live within your means as well as make educated acquiring decisions. There's never a far better time to learn concerning the monetary proficiency principle of loaning than as a young adult. More than half of trainees borrow money to obtain through university, and the class of 2019 finished with about $29,000 in trainee funding debt.

All about Financial Education

It starts with discovering concerning credit history and also debt records, which are several of one of the most important identifying variables when it comes to requesting credit history. As soon as a person has actually developed the economic background to get financings and also credit, it's crucial that they understand their car loan More Help terms, such as APR.Only about fifty percent of Americans have an emergency situation fund, as well as almost 40% don't have money in the financial institution to cover a $400 emergency. A lot of Americans don't know just how much they require to save for retired life, and fewer than 60% are saving for retired life in all. Regarding half of those with pupil loan financial debt regret their decision to obtain as high as they did.

Today, college-educated employees make approximately the like college-educated individuals did in previous generations, when you represent rising cost of living. But when you check out those with a partial university education and learning or none in all, today's youths are earning less than previous generations. Because youngsters are earning less money, it's essential that they learn to manage it.

Top Guidelines Of Financial Education

If this useful content trend continues, it can be the case that today's young individuals make the like and even less than their parents and also grandparents did. Financial literacy is reducing among young people at a time when it's more vital than ever before. As an university student, now is the time to locate means to enhance your understanding of monetary skills as well as principles.If it's real that we're presently in a recession, it's feasible that the supply market, in addition to earnings, may decrease, as business earn less profit and stock owners come to be extra risk-averse and want to other properties to shield or grow their wealth. This is one factor it can be so valuable to preserve a high degree of economic literacy.

This is one more reason to obtain proceeding your personal economic educationthe faster you obtain the fundamentals down, the sooner you can make enlightened decisions. Even better, the faster you have the basics down, the look these up earlier you can increase your monetary education better as well as obtain much more understanding into your one-of-a-kind monetary situation.

In an economic environment where experts are talking about whether an economic downturn has begun, currently might be a blast to begin finding out, or learn much more, about individual money, profile building, and diversity. In the past year, we've put plenty of hours of job into making it simpler than ever before to gain access to our substantial library of post, unique records, videos, and a lot more.

The smart Trick of Financial Education That Nobody is Talking About

To find out even more concerning the safety power of priceless steels, CLICK ON THIS LINK to request a FREE copy of our Gold Information Kit.

This is so due to the fact that youngsters have a very valuable present: time. The future advantages are larger the earlier your young person starts investing cash. Due to the fact that money is earned annually from the earnings of the previous year, this is the result of the magic of compounding, which leads to the rise of gains with the enhancement of interest to a primary amount of the deposit.

The present generation of teens is developing in a globe controlled by electronic financial, where "tap and also go" and also on-line shopping are chosen over using real, physical cash. Observing moms and dads make smart decisions, on the various other hand, wants. Teenagers wish to be involved and also have obligations. What economic education and learning lessons can we give youths who only have accessibility to a few digits on a screen for cash? How can we present them to the relevance of monetary literacy? Introducing our deliberate money conversations and also assumptions will prepare your teenager for adulthood by outfitting them with the experience and also knowledge they need to shield their financial resources and stay clear of costly errors.

Report this wiki page